Newsletter #18 - French Tech Ecosystem Report 2021

France tech in review: the key moments of 2021

Hello everyone, my name is Ghita, and I’m a student at l’ENS. During my VC and startups internships, I created First-time Founders, a media that covers the latest trends in technology, venture capital and entrepreneurship. You can subscribe by clicking on the button below.

2021 was an exceptional year for the French Tech ecosystem: French startups have raised record funding, many new unicorns have emerged and exits have significantly increased.

Istvan and I worked on a detailed report on the French Tech Ecosystem in 2021:

Global context: how does France compare to other tech hubs around the world?

2021 Highlights: what stands out in a post-pandemic year? An overview of French funding rounds in 2021.

Investors in France: French and foreign funds activity across the French ecosystem.

What’s in store for 2022? Our predictions for next year.

You can access and download the full report by clicking on the button down below. In this newsletter, we will give you a brief wrap-up of the key statistics on the French Tech this year. We hope you enjoy this presentation. Feel free to give us your feedback.

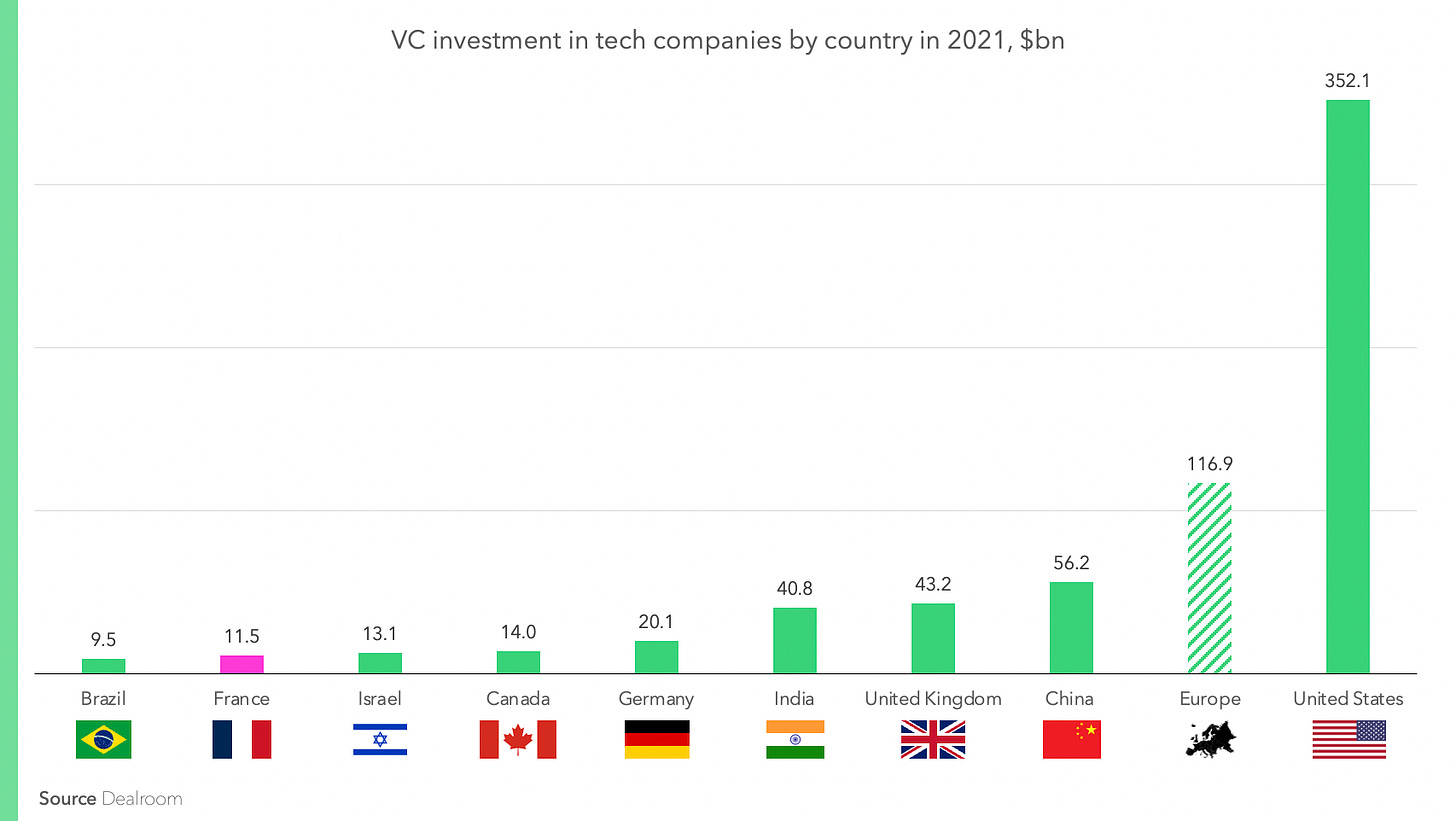

France ranks 8th in the world in 2021 for tech investments.

Canada and Israel pushed France down 2 places in the ranking compared to 2020.

Europe is lagging behind the US because global markets are dominated by US startups. European startups operate in local markets that are culturally and linguistically fragmented.

France remains a vibrant entrepreneurial ecosystem and one of the leading nations in Europe.

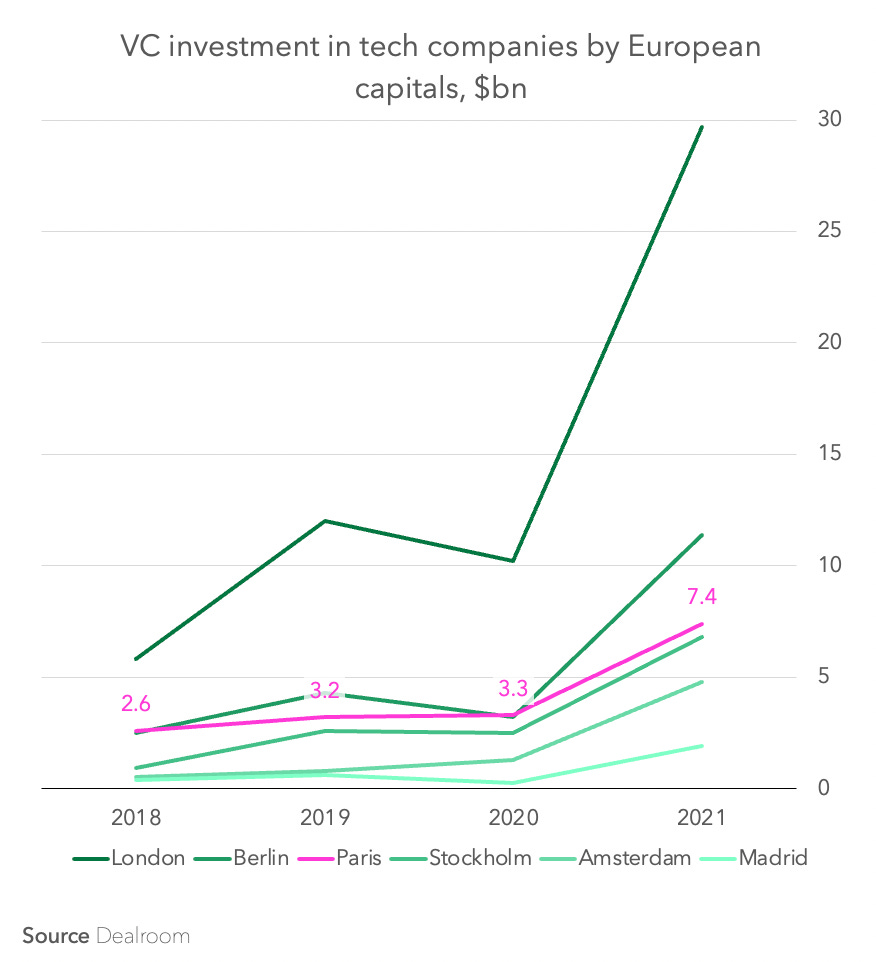

Paris is now the 2nd Tech Hub in the European Union behind Berlin.

Berlin took Paris' first place in the ranking in 2021. The gap between the two cities has increased by $4bn in a year.

London remains the undisputed European leader in VC investment. The investment gap between the British capital and Paris has widened to $22,3bn.

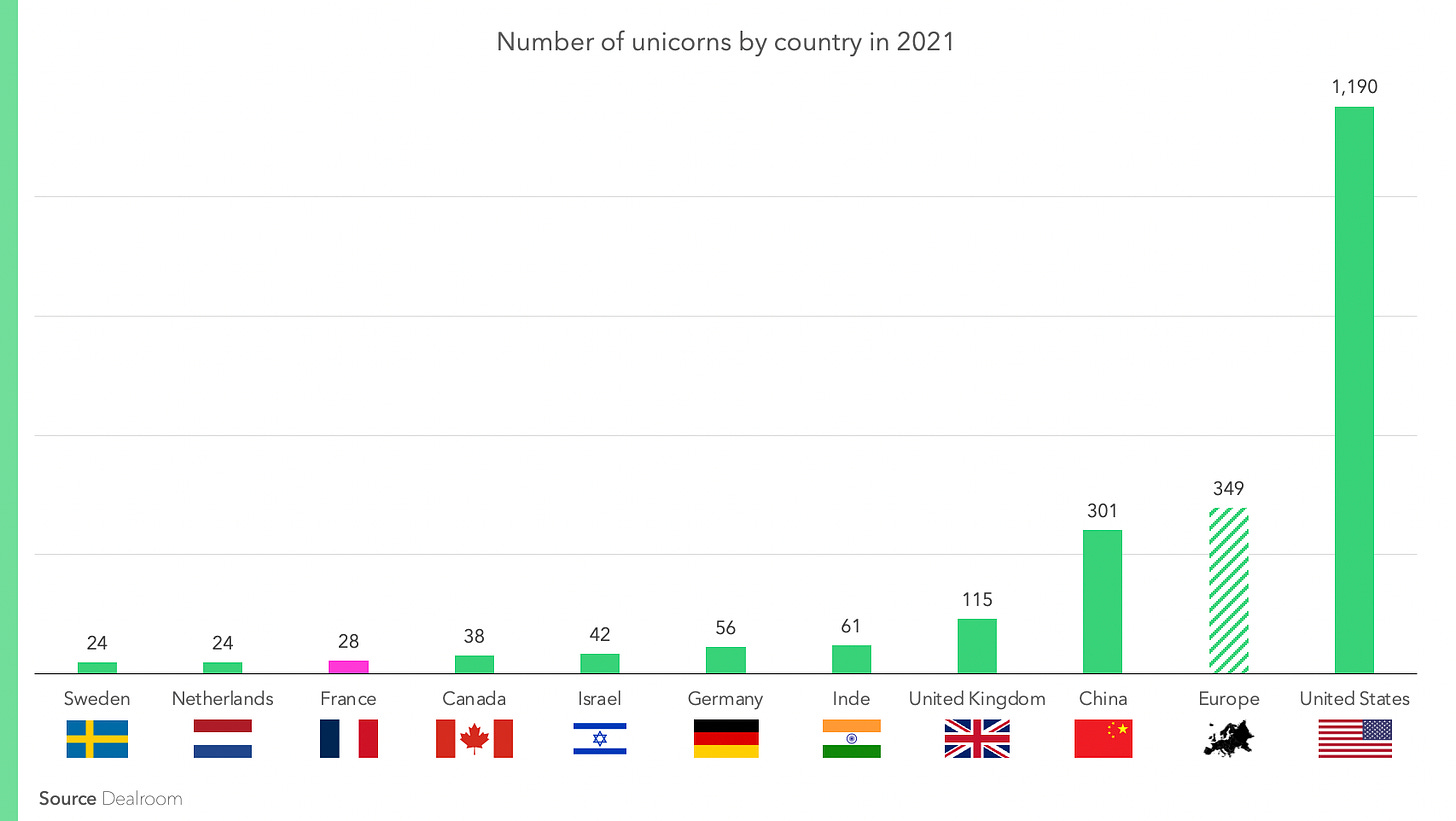

With 28 unicorns, France has now surpassed Sweden and the Netherlands.

In 2021, France has overtaken both the Netherlands and Sweden for the number of unicorns. France is creating unicorns faster than most European ecosystems. It only had 6 unicorns 3 years ago.

Despite the sanitary context, VC investment in France has skyrocketed in 2021.

In 2021, France VC investment hit a record high of €11bn (+107% YoY) raised in more than 830 rounds (+34% YoY).

Many factors can explain this significant increase:

The growing interest of foreign investors.

Policies introduced in the last few years, to support the growth and competitiveness of the ecosystem.

Abundant capital due to the central banks' loose monetary policies.

Post-pandemic change in the use of technology.

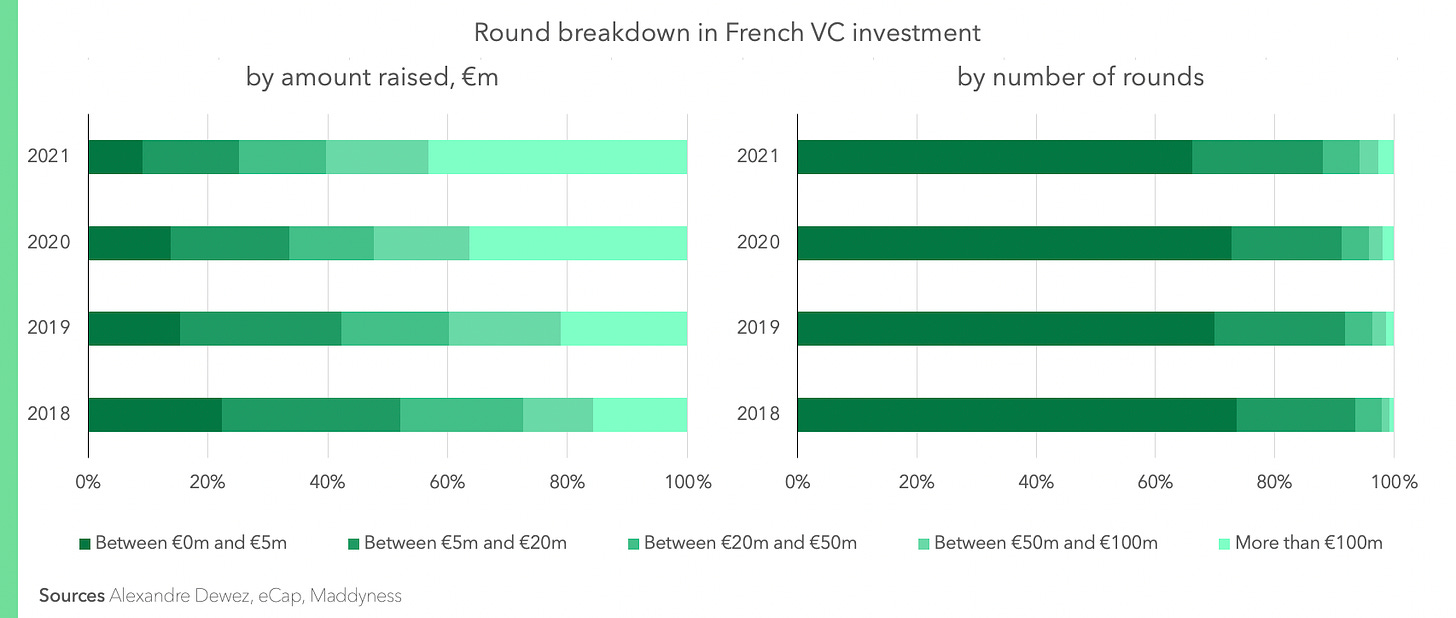

Megarounds are the main drivers of the surge in VC investment in French startups.

A clear driver of the growth of the ecosystem comes from the growing size and number of megarounds, those late-stage rounds of more than €100m.

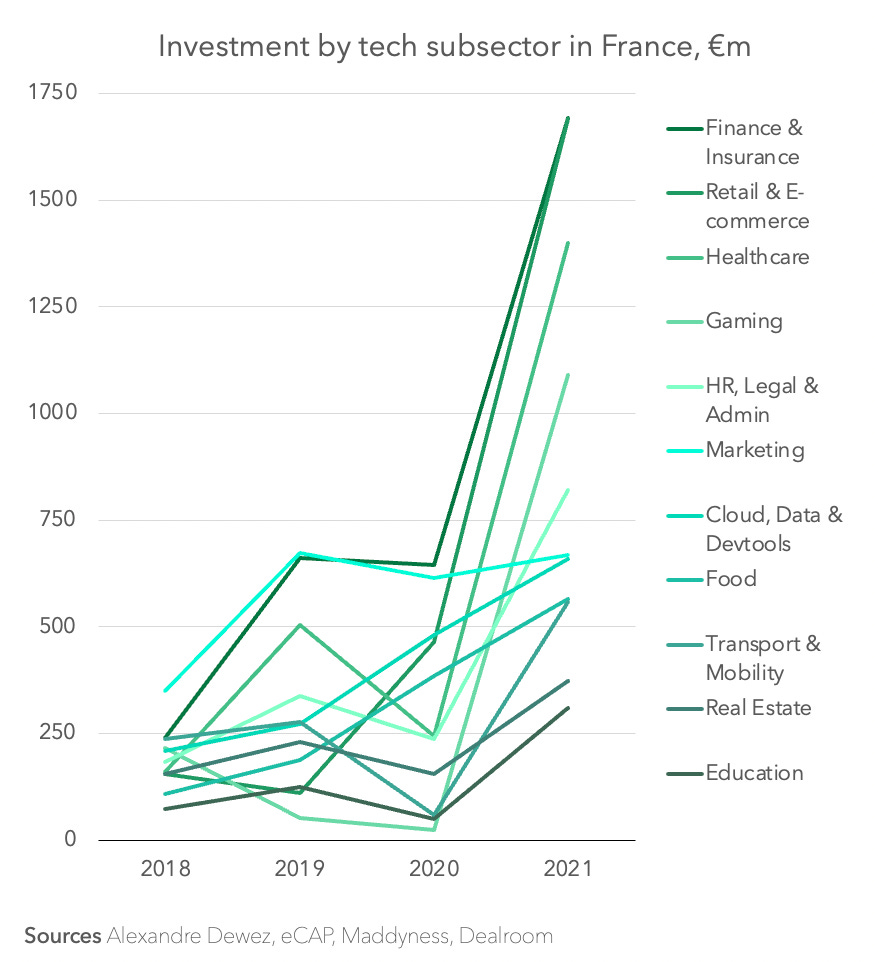

Most investments go to fintech, retail/e-commerce, healthcare and gaming.

While the three sectors have been leading France investments for the past 3 years, gaming has caught up in 2021.

2021 was a year like no other for VC investment into gaming firms (+4,600% v. 2020), but underpinning this astronomical total was a couple of megarounds: Voodoo (€266m) and Sorare (€580m).

Finance & insurance, retail & e-commerce, gaming and healthcare have gathered 53% of the 2021 funding.

In 2021, marketing and cloud, data & devtools showed a small increase while transport rocketed by +860% in a year, education by +515% and healthcare by +472%.

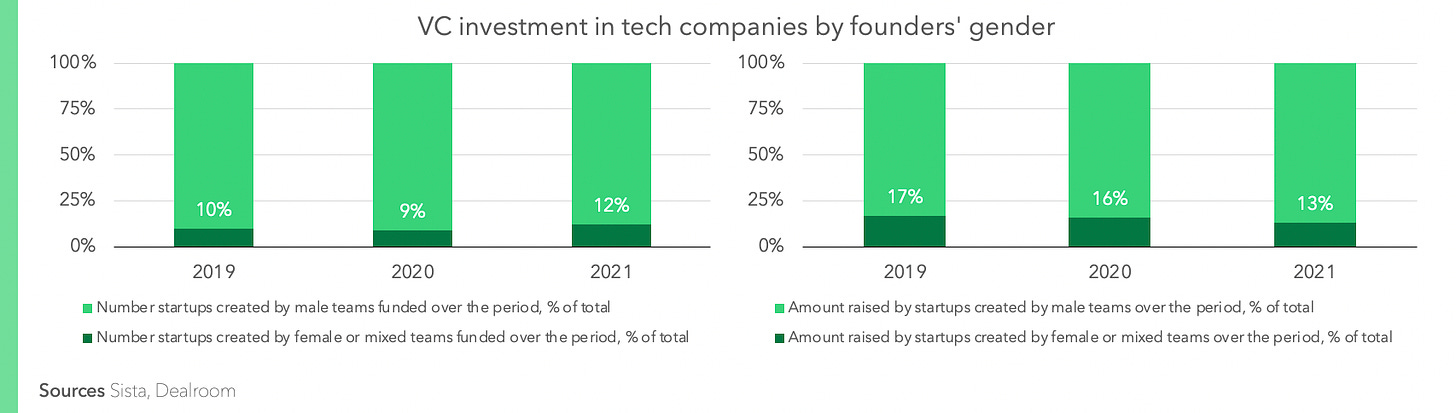

Male entrepreneurs continue to be overrepresented among funding rounds in 2021

More than 85% of the money raised in 2021 was raised by companies funded by men, a percentage that has been increasing since 2019. They represented 88% of the startups funded, a 3% improvement compared to last year.

To learn more about the gender funding gap, read this article.

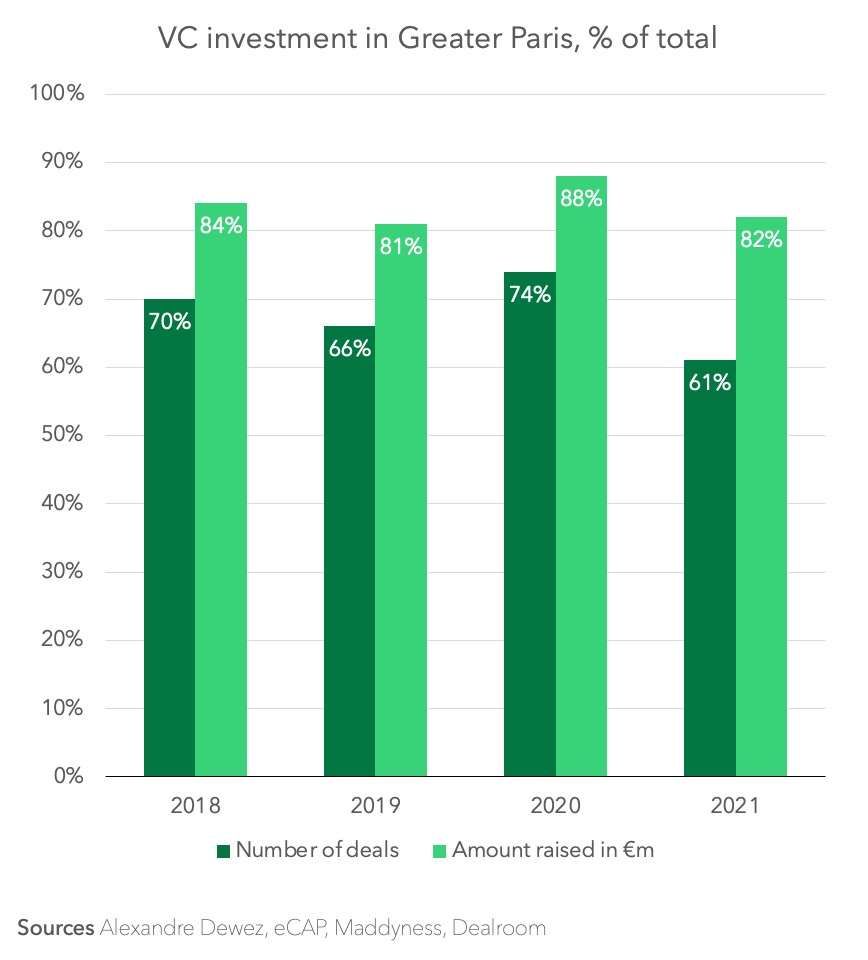

Paris remains the undisputed leader of the French Tech.

Unsurprisingly, Greater Paris remained the most dynamic region for venture capital, accounting for more than 60% of all funding rounds and more than 80% of all the funds raised.

2021 is a record year for exits in value and volume.

In 2021, there were around 300 deals for a total of €7,5bn in deal value, being the best year ever for tech exits in France.

We’ve seen some encouraging development with Believe and OVH IPOs on Euronext Paris.

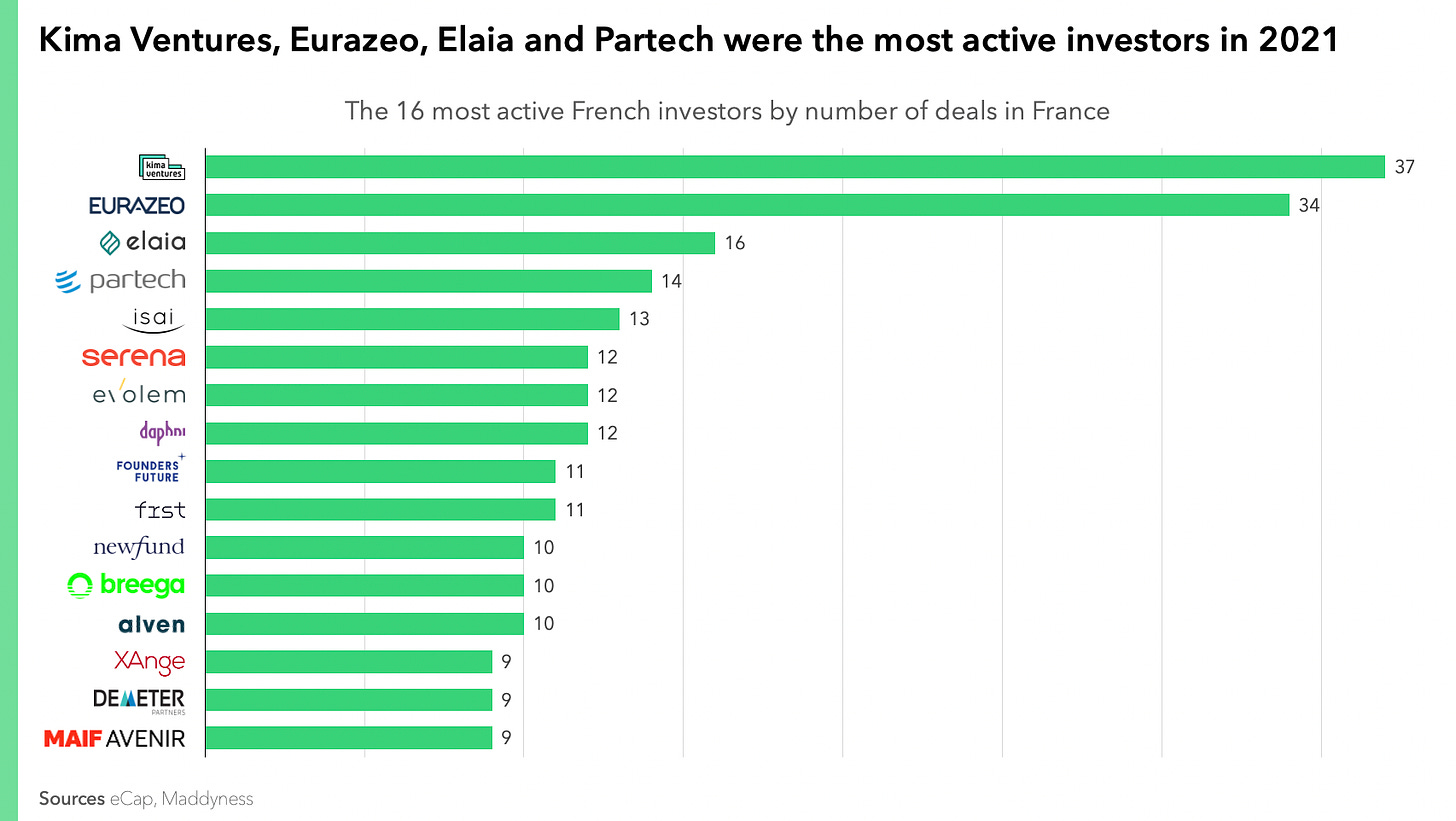

Kima Ventures, Eurazeo, Elaia and Partech were the most active investors in 2021.

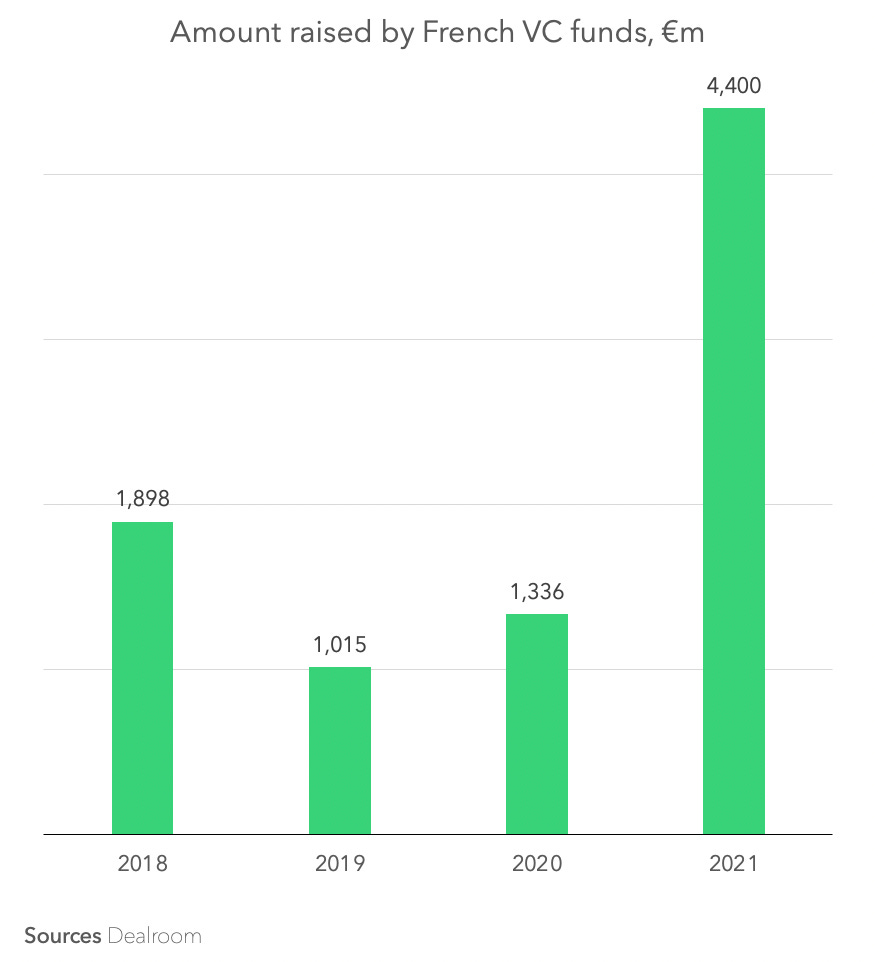

2021 is a record year for new funds raised by France-based VC firms.

€4,4bn has been raised by new VC funds in 2021, more than 3 times as much as in 2020.

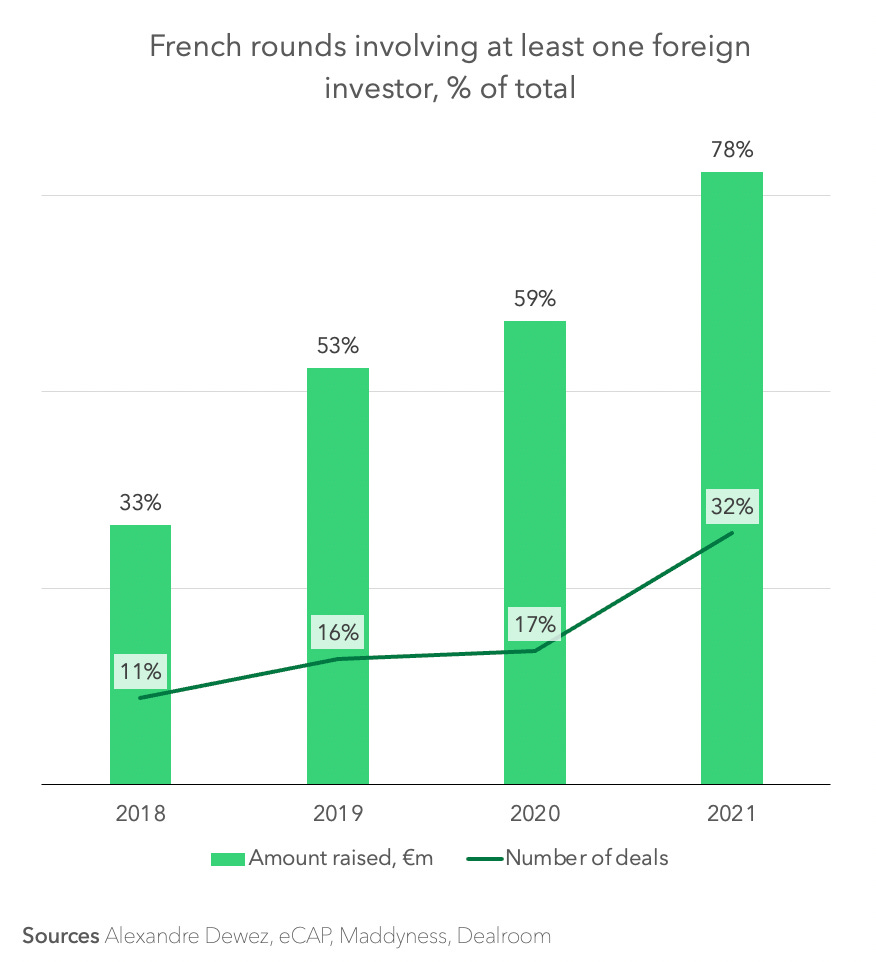

France keeps gaining the attention of foreign investors that lead most of the megarounds.

In 2021, 78% of funds raised by French startups came from abroad (+19% YoY).

Foreign investors were involved in 32% of deals in 2021 (+15% YoY).

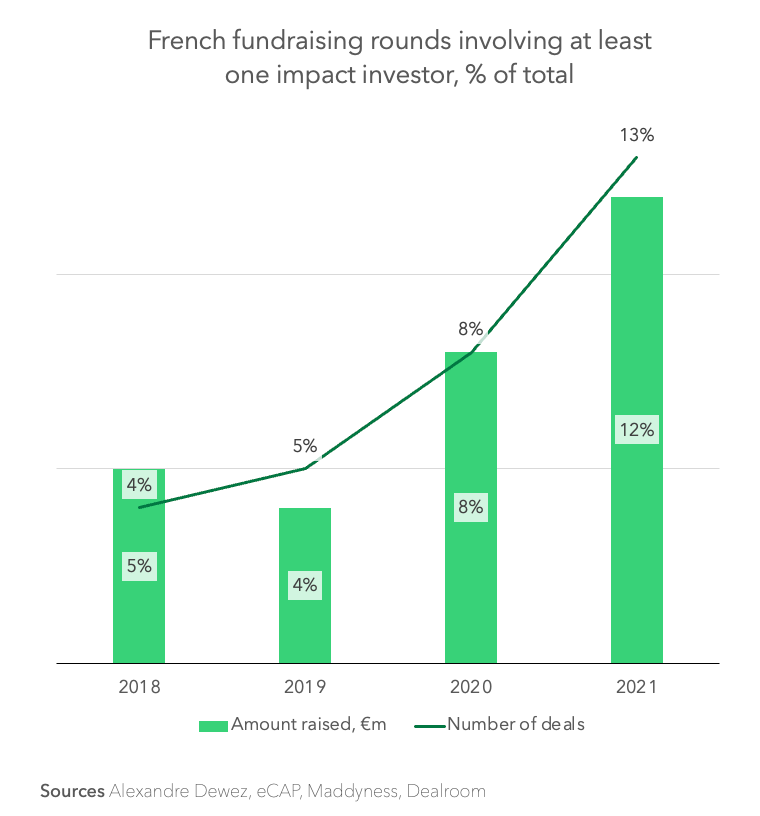

Impact investors are involved in more rounds than before.

Impact investing accounted for 12% of total French VC investment in value, 4% more than last year.

Impact investors were involved in 13% of deals in 2021, 5% more than last year.

To learn more about this topic, you can read this article.

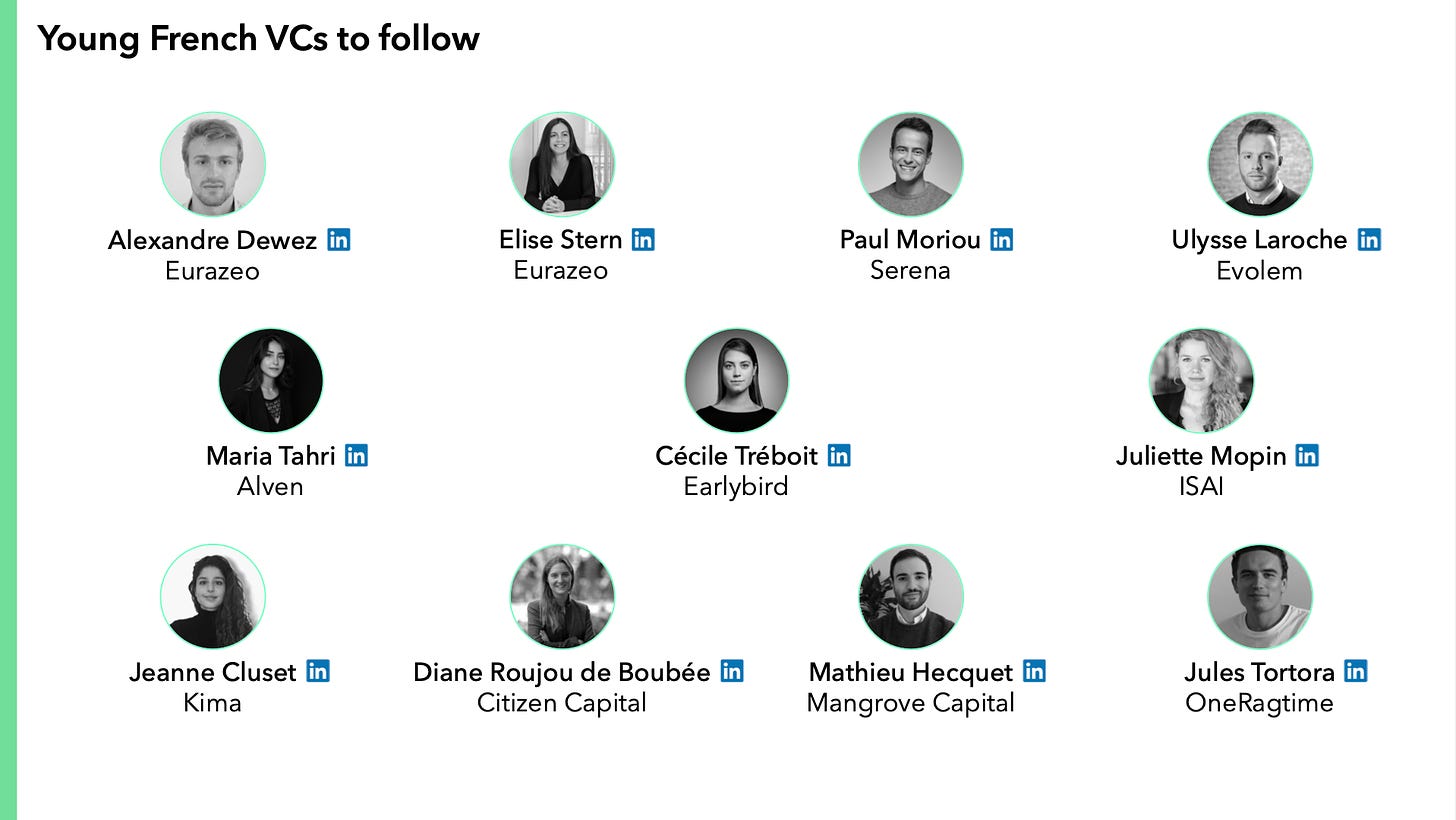

These are the young French VCs you should follow.

These are the seed startups we think you should follow in 2022.

Did you enjoy this newsletter?

Share your feedback and recommendations for the following weeks on LinkedIn or by replying to this email.

Feel free to subscribe to First-time Founders as well.

Thanks to Mehdi, Mehdi, Noé and Ali for the feedback.

See you soon!

Ghita

Great report full of excellent insights 🙏